JACKSON — Public Service Commissioner is the hardest job that few people are thinking about in Mississippi’s crowded election year.

The winners of two open public service commissioner posts will just have settled into their offices in the Woolfolk State Office Building overlooking Mississippi’s capitol when they will be asked to decide the future of the Mississippi Power Co.

Maybe that’s a little strong, but a series of decisions that will be made in relation to the electrical utility and its rate case will go a long way in shaping the future of Mississippi Power, and could influence the future of its parent company as well.

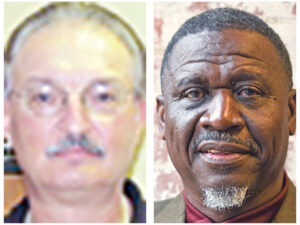

Some of the candidates are already closely associated with the commission. Central District candidate Ryan Brown, a Democrat, has been working as a commission staffer for Central District Commissioner Cecil Brown. The two men are not related. Republican Brent Bailey, also a Central District candidate, has been active in lobbying the commission on renewable energy issues.

Others, though, could be in for a shock when they discover the complicated issues that commissioners preside over. Entergy Corp.’s struggles to keep the Grand Gulf Nuclear Station operating on a reliable basis, for example, influence how much customers pay for power across multiple states. The commission has limited influence on the nuclear plant, though, because ownership is shared across those states, and much of it is federally regulated.

The three-member commission, including returning Northern District Commissioner Brandon Presley, has more direct influence over Mississippi Power. The company plans to ask the commission to set new customers rates in the aftermath of the $7.5 billion Kemper County power plant misadventure, which cost Mississippi Power and its parent, Atlanta-based Southern Co., $6.4 billion in losses.

Customers are paying $1.1 billion worth of Kemper costs, but it’s in a separate rate. The rate case will roll that into the basic service rate, and also re-examine the rest of Mississippi Power’s rate structure.

Other key issues will have to be considered. Mississippi Power is deep in debt because of Kemper, giving it little borrowing room. The company has to refinance or pay off $339 million in debt in the next 12 months alone, its latest financial report shows.

“Appropriately balancing required costs and capital expenditures with customer prices will continue to challenge Mississippi Power for the foreseeable future,” managers wrote in the May 1 report.

Mississippi Power also has excess generating capacity. In August, Mississippi Power proposed closing Gulfport’s Plant Watson in 2022 and closing the Greene County, Alabama, plant that it shares with corporate sibling Alabama Power Co. by 2022. But with Southern Co.’s sale of Gulf Power Co., that company’s new owners plan to close one of two coal-fired units in 2024 that it shares with Mississippi Power at Escatawpa’s Plant Daniel. Mississippi Power can buy the unit for $1, but may not need it. The company generated 96 percent of its electricity using natural gas in the first three months of 2019, and only 4 percent using coal.

Finally, current commissioners have discussed requiring Mississippi Power to join a regional power grid management group, which would let the company buy from and sell to a broader wholesale power market. Southern has never joined such a group, and because Southern pools all the plants across its system, requiring Mississippi Power to join could force the much larger Alabama and Georgia subsidiaries to join as well.

Those are complex decisions for an office so misunderstood that incumbents spend much of the time explaining what they do. But they matter a lot for the more than 600,000 customers statewide of the two private electric utilities.

You can help your community

Quality, in-depth journalism is essential to a healthy community. The Dispatch brings you the most complete reporting and insightful commentary in the Golden Triangle, but we need your help to continue our efforts. In the past week, our reporters have posted 45 articles to cdispatch.com. Please consider subscribing to our website for only $2.30 per week to help support local journalism and our community.